Apretándose el cinturón de cuero de cocodrilo.

Fashion & Style. |

| Tightening the Alligator Belt By STEPHANIE ROSENBLOOM Published: January 27, 2008 |

Ron Barret |

| EVEN Dobbins, the teacup Yorkie, has to downsize. Its owner, Betsy Illium, recently replaced the groomer who specializes in little dogs (and charges about $130) with one from Petco, which charges $65. Ms. Illium, a marketing consultant to medical practices and the owner of four Manhattan apartments (three are investment properties), is fortunate enough to have discretionary income. But the dreary economic outlook has prompted her and Dobbins to scale back. "It's frightening," said Ms. Illium, 45, noting that most of her money is tied up in real estate. She was appalled when she calculated that Dobbins's grooming along with her own weekly hair, nail and massage appointments; gourmet groceries; restaurant meals and Starbucks coffee cost nearly $2,000 a month. Now she gets manicures at a less expensive salon, meets her friends at California Pizza Kitchen and sends her sheets and towels to a laundry service instead of the dry cleaner. These services might be considered luxuries in some cities, but they are frequently deemed necessities in New York City. Rather than do without, many residents like Ms. Illium who are not in dire financial straits are looking critically at their spending. And that decision, marketing scholars and consumer psychologists say, is telling. They suggest that for consumers with disposable income, the act of pinching pennies on everything from toilet paper to yoga classes has less to do with actually saving money and more to do with emotional health. Sure, being thrifty can help people save a few thousand dollars a year, but it can also help them regain some sense of control when the world seems topsy-turvy with stock markets around the world falling last week, brokerage firms announcing billion-dollar losses and those ubiquitous For Sale signs. Yet when these dollar-stretching consumers cut back, they do so in ways that make them feel good and enable them to maintain their status. Robert Meyer, the chairman of the marketing department at the Wharton School of the University of Pennsylvania, does research in areas that include decision making under uncertainty. He likened the daily saving process to "a kind of healing process." "They're seeing all this news media saying the value of your house has gone down, the value of your portfolio has gone down," he said. "Well, none of it is relative to their day-to-day spending. Nevertheless it creates a feeling of poverty, which feels bad. The way they can undo that is their daily savings perks, which make them feel richer." This why people are choosing to be thrifty about visible, routine expenses, he said. "People aren't doing it really because they're saving money." And by cutting corners, he said, "you're not actually depriving yourself in any way, so you kind of have the best of both worlds." |

Ron Barret |

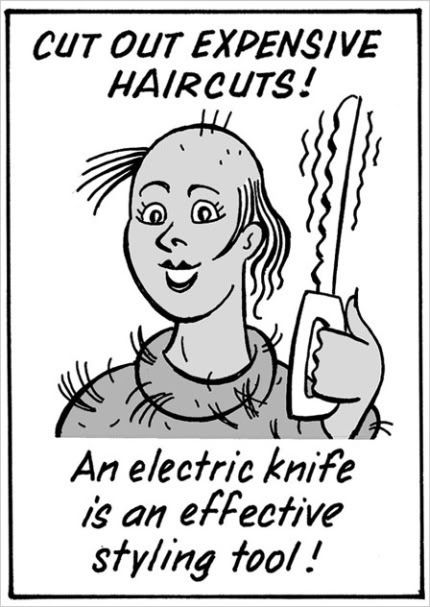

Larry D. Compeau, an associate professor of marketing at Clarkson University and the executive officer of the American Psychological Association Society for Consumer Psychology, agreed, explaining that such behavior is really "a symbolic tightening of the belt" that enables consumers to feel prudent and responsible. "This is how people who are not fighting paycheck to paycheck can feel they're doing something," he said. (Though he pointed out that people may be pulling back only slightly because they are not feeling a downturn.) In this way, people in New York are not that different from people in other cities. Mr. Compeau said that in other parts of the country people may not be looking for cheaper places to send their dirty sheets, but they are buying less expensive bread and skipping dessert. "It's the same type of thing, and that's why we all get nervous when consumers start pulling back," he said. The pruning of daily expenditures could have a butterfly effect, setting off a chain of events that actually contributes to an economic slide and more fear. And increased fear, said consumer psychologists, could lead to further belt tightening. Indeed, retail sales were down over the holidays, leading economists to debate whether the country could experience a rare decline in personal consumption. And consumer confidence has plunged. The Pew Research Center says its polling shows that consumer satisfaction with the economy has reached a 15-year low. "If that fear gets greater they'll probably do more," Mr. Compeau said. "When they're actually telling you 'I'm cutting my coffee bill in half,' Starbucks is going to feel that." Lisa Germinsky, 33, a screenwriter who lives in Gramercy, has just begun to trim back. "My boyfriend and I, we were talking and he's just like doom and gloom, 'impending recession,' his stocks dropping," she said. "And I'm a freelancer, so I'm like, 'Oh, my God.' " She has resolved to travel from Manhattan to her former hair colorist in Greenpoint, Brooklyn, because a single-process color there is $40 ($44, factoring in the round-trip subway ride) instead of $100 or $130, which she paid at a Manhattan salon. And the Greenpoint salon is not teeming with assistants requiring tips. Last week she went on the Internet to see whether she could buy a tea-based fermented drink known as kombucha (her preferred beverage) by the case. |

Ron Barret |

| And? "I stopped looking because I thought I really better get to work or I won't be able to buy any kombucha," she said. Joe Priester, an associate professor of marketing at the Marshall School of Business at the University of Southern California and the president of the Society for Consumer Psychology, is not surprised people scale back instead of abandon certain habits. "In a way, a lot of these brands have become safe harbors for us," he said. "People build attachments to brands over time, and those are very much like friendships or buffering devices in our world. You don't hear people saying, 'I'm not going to Starbucks.' It would be like saying 'I'm going to cut off this friend.' " In a working paper under peer review, Mr. Priester and colleagues write that "consumers see brands as part of themselves" and the greater the attachment to the brand, "the more difficult the behavior the consumer is willing to enact in order to maintain the brand relationship." Additionally, Jeff Greenberg, the director of the social psychology program at the University of Arizona, explained in an e-mail message that frugality "will generally be with regard to products and services that don't undermine the individual's material bases of self-worth and prestige. If a person's self-worth is invested in his/her car, wardrobe, apartment, ability to send their kids to private school, etc., they will cut corners in relatively invisible ways that don't affect their self-worth to preserve those things." Or as Rachel LeMaster, 29, a grade-school music teacher who lives in Washington Heights, put it: "A lot of what you spend goes toward showing other people what you have." She still gets a massage once a month ($40 for 46 minutes) and spends money on her hair ("hair is worth the money"), but she too has reduced her spending: cooking with friends, only buying paper goods on sale, tempering her hair product demands and scouring the Village Voice for local artists playing free concerts. Lena Datwani, a real estate agent who lives in Midtown with her husband and children, is thinking about the fact that her daughter is only five months away from college. She still orders take-out food, but less frequently and the family picks it up. Their cleaning lady comes once, not twice, a week. They clip coupons and drive to New Jersey to visit family and shop in bulk at Costco and BJ's Wholesale Club. Patrick Kiely pays $700 a month (utilities and cable included) for an apartment in Woodlawn, the Bronx (a fire left him bereft of his rent-controlled one-bedroom sublet on the Upper East Side that was $750). "But it's the Bronx," said Mr. Kiely, 32, who works for an environmental group. "It does put a damper on the social life at times." Even with his low housing costs, Mr. Kiely rents fewer DVDs, borrows books from the library and reads the news online. "The newspaper," he said, "I never buy it anymore." |